How to Email Donation Receipts

Sumac can generate encrypted, government compliant electronic tax receipts that can be sent to donors. This can help reduce your organizational costs as you do not need to print and mail as many tax receipts.

To email donation receipts your administrator needs to configure Sumac to send email and you need email templates.

Test templates with a mail merge to make sure that everything works properly before using.

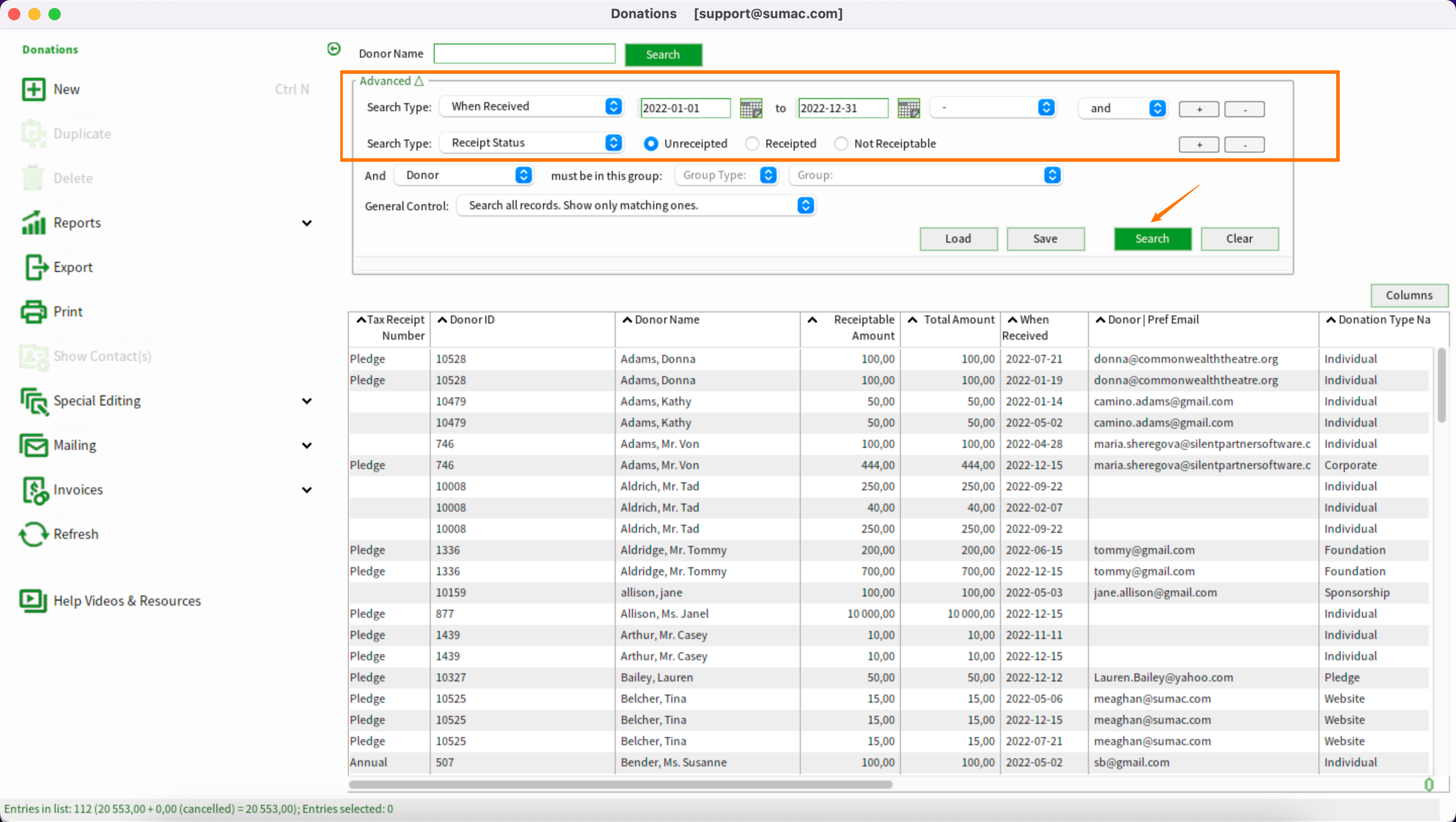

Test templates with a mail merge to make sure that everything works properly before using.Once Sumac is configured and your template is ready to go you can generate your receipts. In your Donations list, search for the donations you want to create receipts for.

In this example we will process annual receipts. Select donations received last year with the receipt status “unreceipted”. Click Search.

Select all the donations in the list and expand Mailing. Click Make Receipts.

Choose which donations you want to create receipts for. In this example, we will select all types as we are running annual receipts.

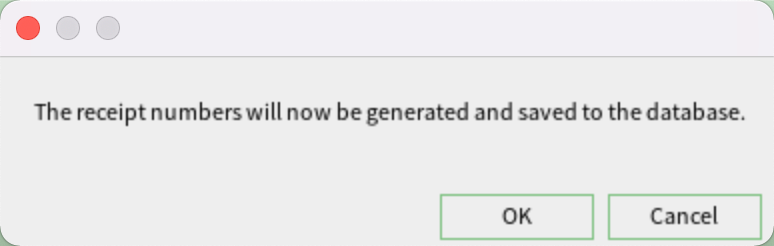

Sumac presents the message that receipt numbers will now be generated, and takes a moment to complete the process of saving them to the database:

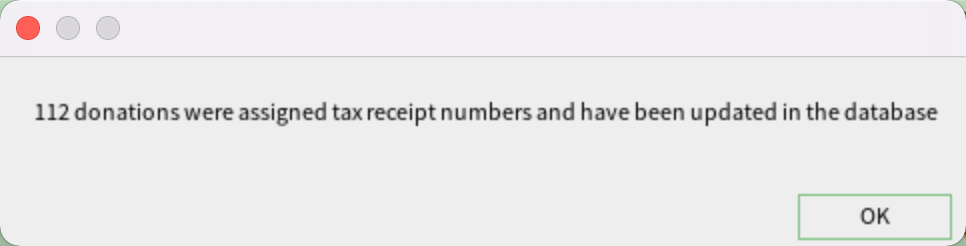

Once the receipt numbers have been generated and saved, the following message will come up:

Click OK, and Sumac asks you to choose the template to be used for creating the receipt documents. If you have previously saved an email receipt template into your database and assigned it to a set, you can select the set that holds your email receipt template. Alternatively, you could opt not to use a set and select the template saved to your computer.

For more information on uploading your receipt templates to the database and assigning them to a set, please review the following articles: How to Upload Templates into Sumac and How to Use a Set of Templates).

In this example, we will choose the Email Receipt Set saved in the database.

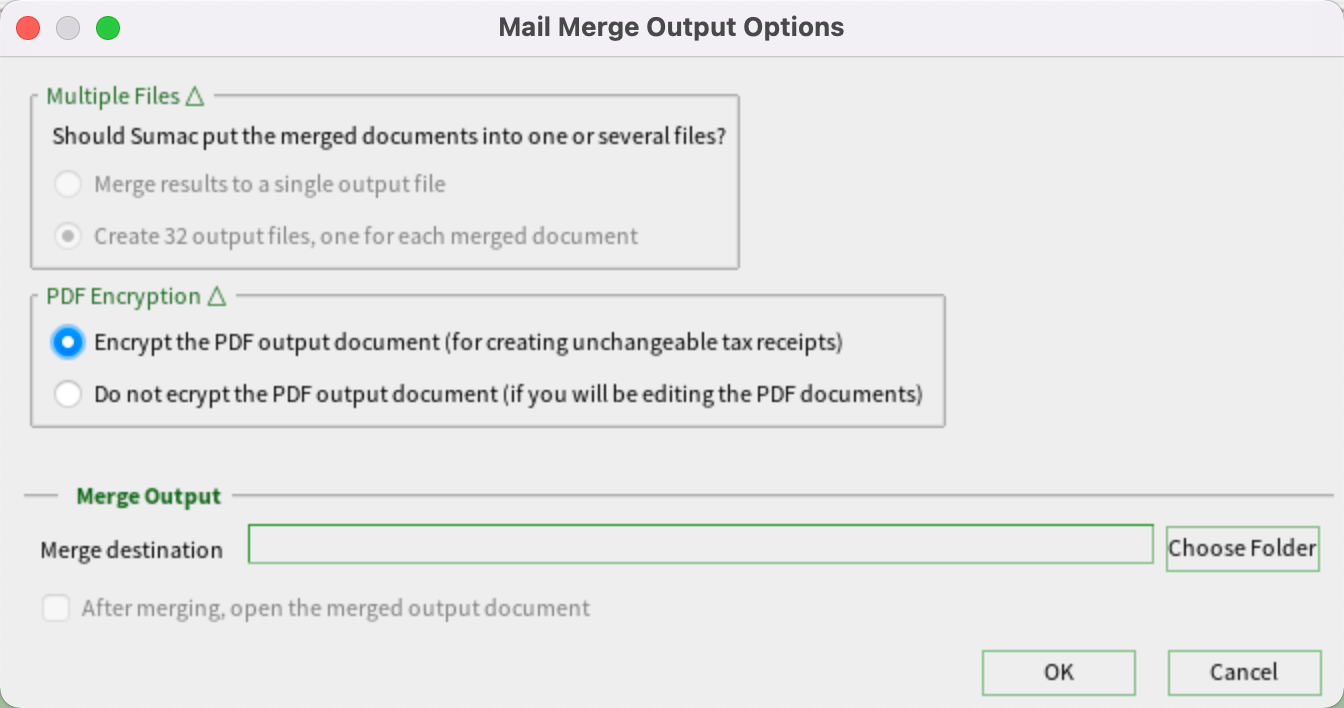

Click Use Set, and Sumac presents the window with the mail merge output options:

Since we’re using a PDF template Sumac realizes that we’ll need to save multiple files for emailing these receipts.

Although you can choose not to encrypt the output document, because these are receipts that should be un-editable, select the encryption option.

Sumac also asks you to choose a folder to hold the merged documents. It is recommended to have a designated email tax receipts folder. If you have not already created a folder for receipts, you can create a new folder.

Click OK to confirm that Sumac should create the merged documents as separate files and save them in the designated folder.

Sumac asks if you want to save a communication record to indicate that you made receipts for these contacts. Since we still have to email the receipts to the donors, click No. We can save the communication records when we actually email the receipts.

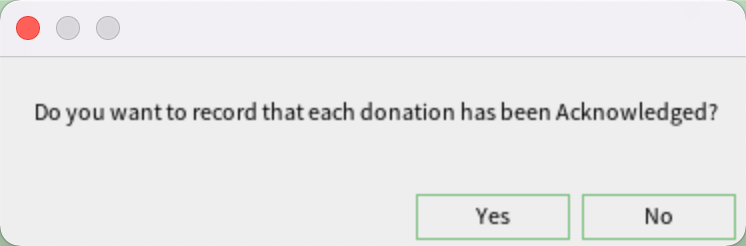

You also have the option to record that each donation has been acknowledged if acknowledgements are used at your organization. If it's not applicable, click No.

You also have the option to record that each donation has been acknowledged if acknowledgements are used at your organization. If it's not applicable, click No.

Next, click Email Receipts under Mailing.

Sumac asks you to choose the folder that holds the receipts you want to email. Select the appropriate folder and click Choose.

Sumac shows you a list of all the receipts in that folder, along with the appropriate donor contact for each receipt, and the donor’s email address.

If you have donors who prefer print receipts, create a communication type “Prefers Print Receipts” using Field Values. You can then exclude this group by clicking Filter & Select.

Click Start Bulk Email, and Sumac asks you to confirm that you want to send the receipts to these contacts. Click Yes.

At this point, the process is the same as sending any email through Sumac. Choose the office to send the email from and provide a subject line. Select an html template for the body of the email, or quick compose some information into the email.

If you have created a thank you letter template to use when emailing donation receipts, you can choose that template for this email. You can either choose the template from your machine or the Sumac database if you uploaded the html template to the database previously. The body of this email should indicate that you are emailing the recipient a tax receipt, which is included as an attachment to this email.

Sumac automatically attaches the appropriate PDF receipt to each contact’s email.

Click Send, and Sumac asks if you want to save a communication record for the contacts you're emailing. Since we're sending a thank you letter as well as a receipt, it's a good idea to take advantage of this feature.

Sumac tells you how long it will take to send the emails and asks where you want to save the status report for this email, which tells you whether each email sent successfully, and if not, why it failed.

When the emails are sending, a progress window opens in the bottom right corner of the screen. You can continue to use Sumac while the email is being sent.

Do not close this window as it causes the sending of emails to stop immediately.

Our products got an upgrade!

Some screenshots and help videos have been made using older versions of our products. Though your version's colours and themes may appear different than what you see here, the instructions, links and advice in this article are still accurate and useful!

Related Articles

How to Make Donation Receipts

Make Receipts works like a mail merge, using a template that generates tax receipts. Before making receipts ensure that you have a tax receipt and thank you email template ready to use. If you do not have a tax receipt template, there are standard ...How to create Annual Donation Summary Letters (U.S. Style)

Creating U.S. Style Annual Donation Summary letters is done by running a mail merge and using a template that generates the Annual Donation Summary letter. We recommend starting with the pre-built template on our website titled “U.S. Style Annual ...How to Make a PDF Receipt Template for Sumac

This article describes how to make a PDF tax receipt template using Open Office (Libre Office). Silent Partner Software offers a receipt template service - let us set up your receipts for you! For more information, book an appointment with your ...Are Donation Tax Receipts created in Sumac IRS compliant?

Sumac provides the technology you need to create IRS-compliant annual donation summary letters, and the standard U.S. Style Donation Summary Letter template we offer on our Support Portal meets those requirements as well. Silent Partner Software ...Does Sumac automatically receipt online donations? How do I set this up?

If you are using Sumac's Website Integration service, Sumac can automatically receipt online donations. When someone donates online, Sumac will send the donor an email confirming that the donation was received and will send the donor's receipt as an ...

Societ Academy

Learn what you need to know, any time. Free!

- High quality training on demand - sessions are available every day, so you can access training that fits into your schedule.

- Training sessions that are easy to follow - helpful tips throughout each session, and access to training moderators ensure your questions get answered.

- A certificate of completion - you can request a certificate of completion for every session you attend.